Lagging New Home Sales

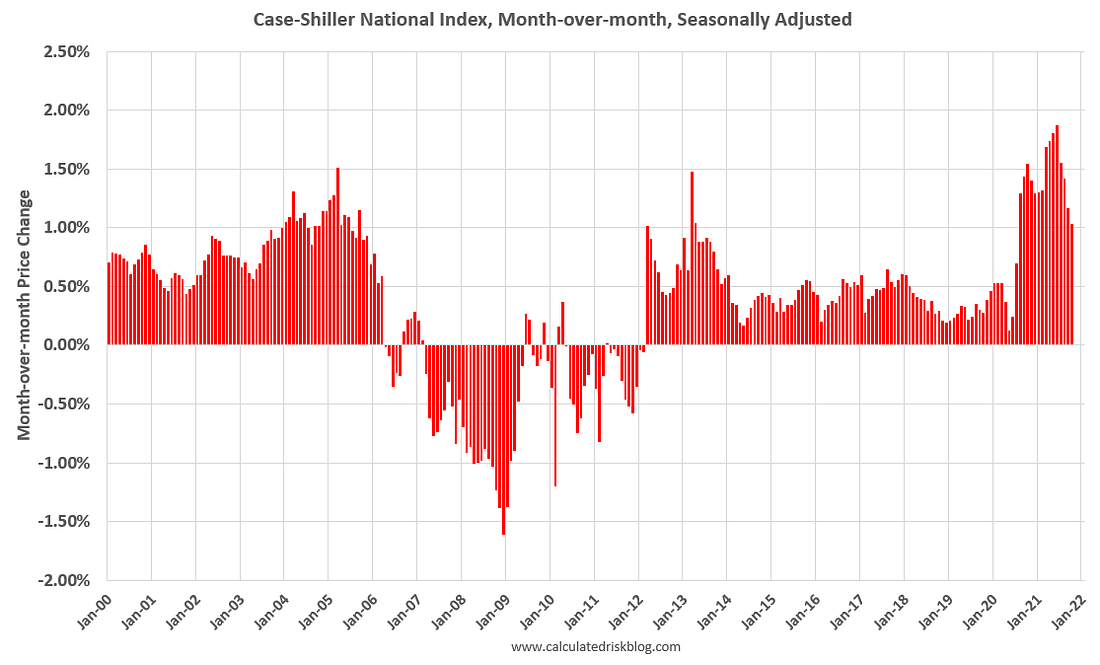

The housing market experienced substantial price appreciation over the past 24 months. Recently, the rate of increase has fallen. In mid 2021, various reports showed the price of an average house up about 20% year over year. But the number of existing home sales fell for three straight months before a brief stabilization. In November, the sales index fell 2.2% (one month) or at a rate which would exceed 20% if continued through the year. Previously, FOMO buying and lagging new home construction were the culprits in price jumps instead of sustained new demand. For more insights, pick up a copy of Winning Mortgage, Winning Home for you or gift one to a deserving friend!

At the end of 2021, we see the price surge weakening. New listings of homes for sale have jumped. This takes pressure off prices. New builds from builders remain a wildcard. But new home sales fell more than 10% in December 2021 as lumber prices rebounded by tripling in price in strong seasonal demand.

Large institutional buyers such as Zillow put a halt on purchases in October. Zillow bought too many homes in a buying frenzy and doesn’t have the capacity manage them. It bought more than $2 billion in houses in the 3rd quarter alone. Then Zillow announced losses in early November after buying nearly 10,000 houses (and contracted for 8,000 more) they never should have bought at prices they never should have paid. They helped push up the prices in many markets, paying cash for homes.

Now Zillow intends to sell roughly 9,800 homes it owns, plus another 8,200 it had been in the process of buying. The company expects to lose between 5% and 7% on these sales. Zillow estimates losses at more than $500 million. Other, third party estimates range to more than $1 billion for Zillow. If you tried to buy against Zillow, chances are they bid over asking price by as much as 25%. Zillow paid cash with a short close. How well could you compete?

As of year end 2021, Zillow has contracted to sell about 2,000 of the homes to a large rental company. It recently added down payment assistance up to $17,000 for buyers of its inventory as the homes it owns aren’t selling rapidly.

Buyers and Home Availability

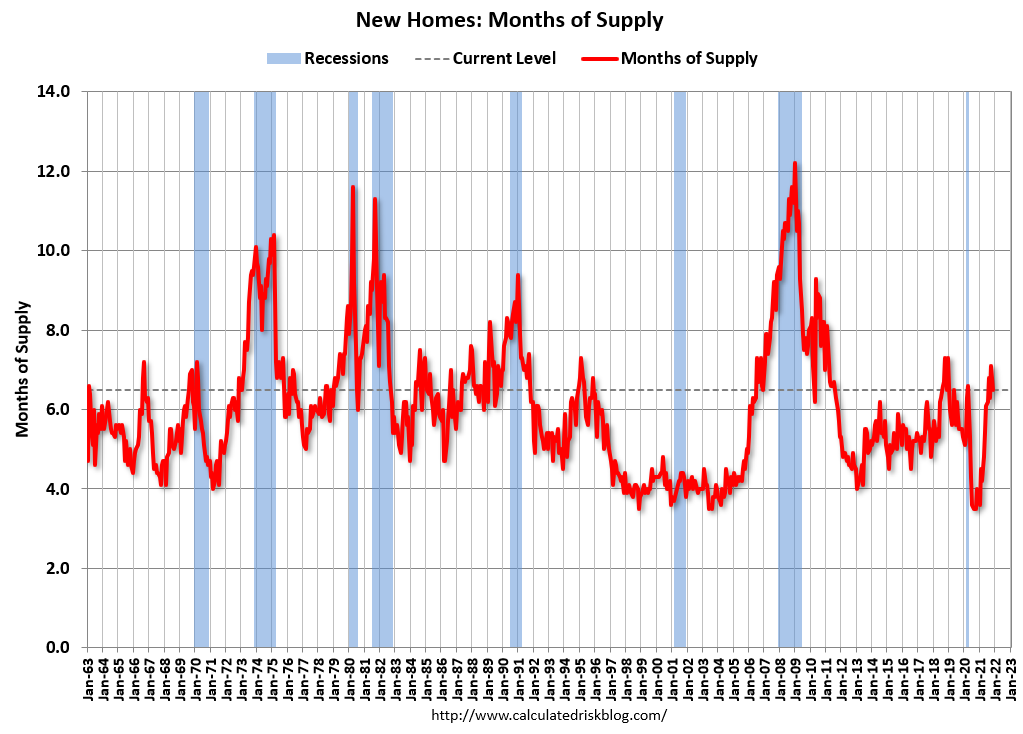

According to the chief economist of the National Association of Realtors (NAR), even more homes may come on the market and begin affecting the price appreciation rates seen. The inventory of available homes jumped more than 10% from the prior month to nearly 1.2 million homes. NAR reports a few months inventory available, however, according to the Federal Reserve, it now reflects nearly 7 months supply, the highest in 2 years. With a 6 month inventory widely considered a balanced market, the market has dramatically changed.

According to NAR as of November 2021, listing price growth has remained stable for the past four months. More homeowners are planning to sell in the next 6 months. And single-family home construction continues at higher rates than recent history.

First time home buyers represented less than one-third of buyers. In the spring we noted an influx of cash buyers for investment properties jumped into the market led by Zillow. FNMA and FHLMC restrictions on lending to second home buyers and investors kicked in on April 1. A spike in cash buyers for investment properties pushed all-cash sales to 25 percent of transactions in April. This rate more than doubled from 2020. With Zillow’s reversal, the entire trend may reverse.

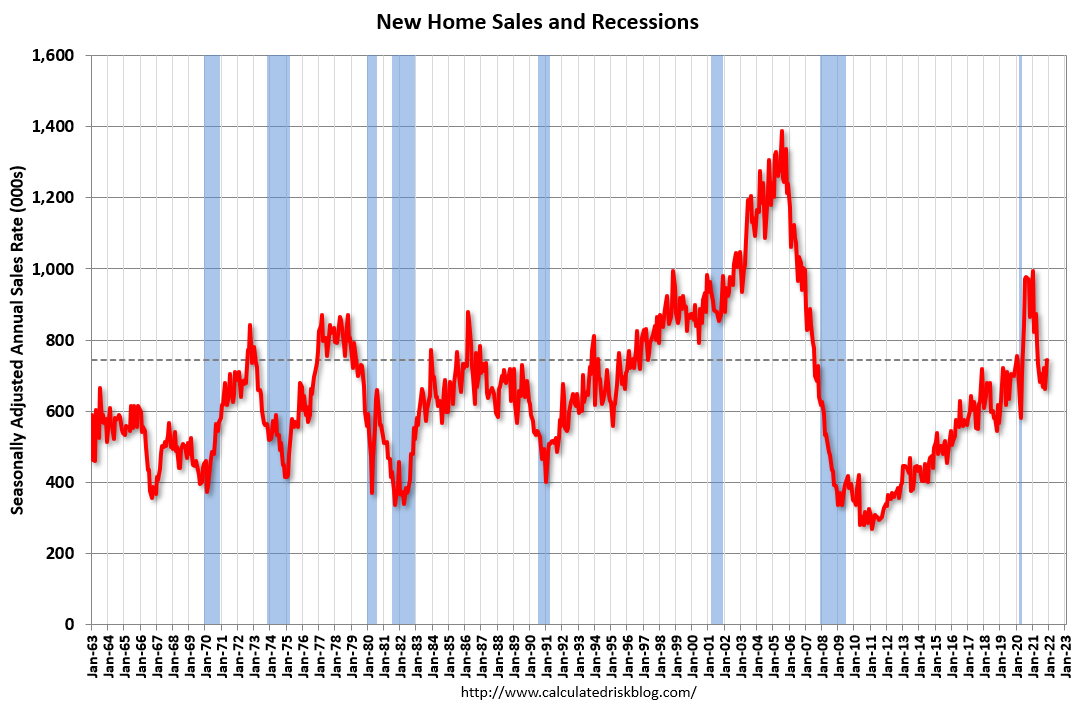

New Home Sales

In the spring, New home builders continued raising prices due to materials price increases and slowed building. They continued sales at the higher prices. Now, home construction has accelerated, bringing more homes to market.

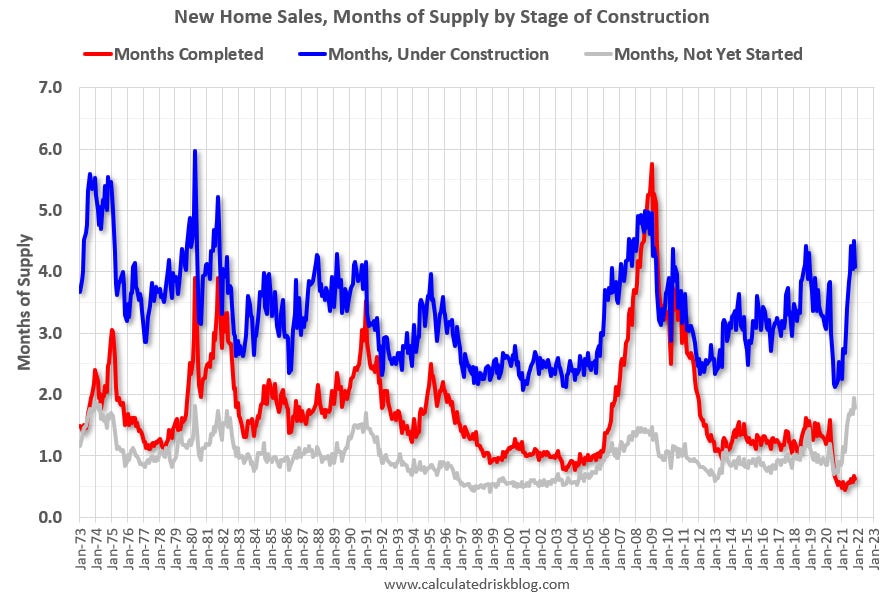

However, new home sales, or the lack of new home sales and building, have been a key driver in price increases. According to one measure, there are 110,000 homes not yet started and which have been planned. Builders appear to be holding back, likely due to high materials costs, shortages, and other uncertainty.

Pricing Concerns

Still, builders express concern about appraisals not supporting the new selling prices and bids. Appraisals generally lag price increases. But they also take into account that bidding frenzies may not accurately reflect valuation. So appraisals may rise, but not as fast or as much as out of control bidding. Builders don’t want to be caught with a number of houses built at sky high materials prices only to have no buyers able to get appraisals at a high enough value to close on purchases. Inflation has become a big worry.

CoreLogic, a giant mortgage information services provide forecast a quick and steep fall in price appreciation over the next year. Take a look at the comparison of the forecast to 2008. Then notice that the peak has passed and appreciation already is on the down slope.

Forbearance Effect

In our forecast of the Advantageous Purchase Window, we note the effects of forbearance. 2 million borrowers remain in forbearance as of October A number of borrowers have been able to exit forbearance through options outlined here in prior posts. However, the number of borrowers re-entering forbearance has now begun exceeding the number exiting forbearance. This statistic signals that the hardest hit in forbearance may see few or no real options to exit. This will build the foreclosure pipeline and bring more existing home to market. Pick up a copy of Winning Mortgage, Winning Home to be prepared how to take advantage as the market changes.

It’s still early in that foreclosure cycle and the CFPB wants to block as many foreclosure actions as possible. But the number foreclosure postings jumped in the last two months as forbearance ended. Time will tell if that creates a larger market problem or not. In the past, such government actions have served to upend the normal market clearing and cause more problems than solutions.