Conforming Loan Limit Not Affordable

Fannie Mae (FNMA) and Freddie Mac (FHLMC) represent the gorillas in the home loan market. Since both are in conservatorship (they went broke in 2008) under the federal government, the Federal Housing Finance Agency (FHFA) exerts total control over them. These two entities are referred to as Government Sponsored Enterprises (GSEs) since they have always had a federal government related role in home lending. Each year, FHFA sets a new maximum loan amount the GSEs can make to borrowers. Most other lenders follow this limit unless they make “non-conforming” loans. These non-conforming loans require lenders to find other sources of money to be lent. This November, thanks to massive inflation engineered by the federal government, the conforming loan limit jumped by the most on record. Why is the new conforming loan limit not affordable for most borrowers?

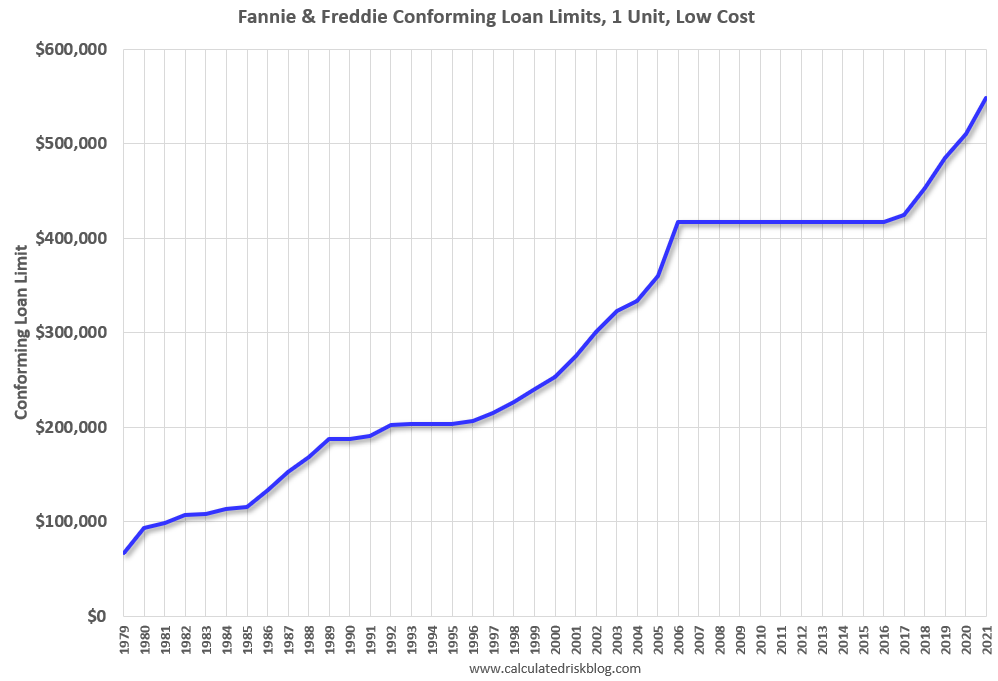

FHFA set the top loan limit for FNMA and FHLMC mortgages at $548,000 for 2021 for most of the country. On November 30, 2021, FHFA announced the new loan limit for 2022. It rises to $647,200, an increase of 18%. The federal government will now back mortgage loans of nearly $1 million. In high-cost areas, the limit rises to $970,800 — or 150% of $647,200.

Special statutory provisions establish different loan limit calculations for Alaska, Hawaii, Guam, and the U.S. Virgin Islands. In these areas, the baseline loan limit will be $970,800 for one-unit properties.

So much for these entities promoting “affordable housing.” Plenty of money exists for loans over $500,000 from non-government entities. Raising the loan limit takes the focus of FNMA and FHLMC away from affordable lending towards the most profitable lending-high dollar loans.

For more insights, pick up a copy of Winning Mortgage, Winning Home, or gift a copy to a friend! How can I also avoid bad advice and information?

Conforming Loan Borrowing Limit History

Note that the maximum loan limit doesn’t get adjusted downward. It was flat for about 10 years to 2016 at $417,000. Since then, it has steadily risen. With the loan limit jump, that line turns almost straight upward. Loans over the maximum conforming loan borrowing limit are “jumbo” loans. In the current market, the rates for jumbo loans and conforming loans don’t differ by a material amount. That can change and it has varied in the past. At times, the jumbo loan interest rate might be 1/2% to 1% or more higher than the conforming loan interest rate. With interest rates set to rise in 2022, perhaps taking a big jump, this differential may return.

Now, look at the housing prices graph with a price to rent ratio. This graph tracks an overall price change for housing. It also tracks how rent increases compare to price increases. Reading this in conjunction with the graph above, one thing should stick out. The price and rent changes in the most recent few years look a lot like 2004-2006 just before the housing crash. In both instances, the peaks deviate enormously from the long run trend line. And, in the graph above, the ceiling on conforming loan limits which will be added for 2022 jumps more steeply in a similar time period just before the crash. Both show cases of FOMO. Either rents will jump even more than they have done so far or home prices will fall. Or both. Or even both will fall.

Federal Housing Regulators Have Learned and Forgotten Everything

Should the government subsidize buying houses that cost $1.2 million? The answer is obviously no. But the government is going to do it anyway through Fannie Mae and Freddie Mac. The Federal Housing Finance Authority (FHFA) has just increased the size of mortgage loans Fannie and Freddie can buy (the “conforming loan limit”) to $970,080 in “high cost areas.” With a 20% down payment, that means loans for the purchase of houses with a price up to $1,212,600.

Similarly, the Federal Housing Administration (FHA) will be subsidizing houses costing up to $1,011,250. That’s the house price with a FHA mortgage at its increased “high cost” limit of $970,800 and a 4% down payment.

FNMA and FHLMC have been broke now for 13 years and under total federal government control. Can you say “we buy risky mortgages?” FNMA and FHLMC have only about 1% capital to their $6.1 trillion mortgage portfolio. And they own the riskiest loans. In fact, the pattern looks a lot like 2006-2007, just prior to the 2008 reckoning.

Making Risky Loans— who makes them?

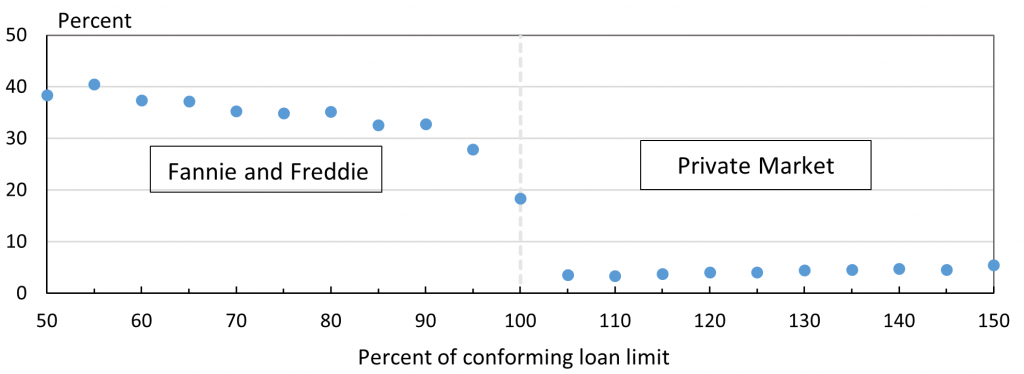

Above dot graph: Percent of loans with DTI ratios exceeding 43% limit for loans at each point relating to conforming loan limits.

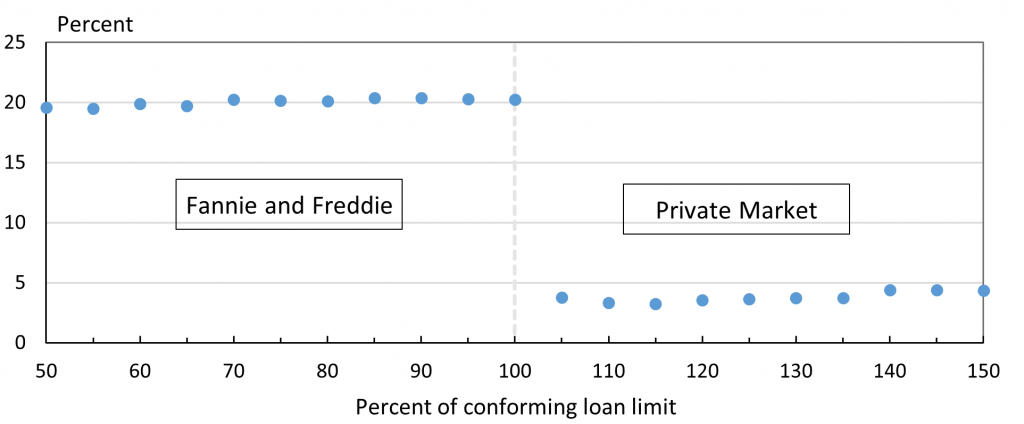

Below dot graph: Percent of loans exceeding 90% LTV for loans at each point relating to conforming loan limits.