Zillow Effect

Who hasn’t gone to the Zillow website to look at a house value estimate or to pretend your house is worth what they say or more? Zillow put all that data to use buying homes. When web surfers searched more frequently about a particular submarket, Zillow’s AI concentrated bidding for houses there. The computer algorithms created a ”Zillow Effect” where these home prices jumped. Zillow paid cash, so its offers went to the top. In addition, Zillow had short inspection, or no inspection, times prior to closing. It didn’t need an appraisal. It didn’t need a separate home inspector. If you competed against Zillow, you either had to bid way over asking price or not buy a home. In effect, Zillow alone helped create house price inflation.

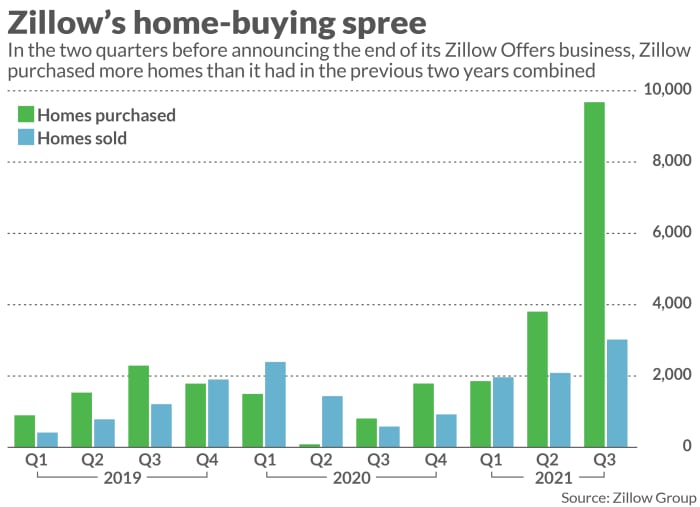

Now Zillow finds that its process didn’t quite work as planned. It bought too many houses. It lost a lot of money and is said to close its home buying business. Zillow can’t handle the volume it bought. It likely overpaid for many of them. So Zillow just put at least 7,000 houses on the market at one time. That’s 7,000 too many houses bought at inflated prices. Now the reverse Zillow Effect may occur. Where are those houses? Will these areas suffer deflation in home prices based on the selling? Will larger buyers step up at a price that doesn’t force prices down? Large investors buying in bulk look for price opportunity. They don’t look to buy at the top of the market. So a bulk sale likely will occur at a lower price than Zillow paid. Will regular home buyers get the opportunity to buy? It depends on how low the offers Zillow receives in bulk come in at.

What Now?

In Zillow’s own words:

Zillow, the digital real estate company, said on Tuesday that it’s exiting Offers, its business that buys and flips homes, and eliminating 25% of its workforce. The announcement was attached to Zillow’s third-quarter earnings report. The company’s revenue and earnings missed analysts’ estimates.

“We’ve determined the unpredictability in forecasting home prices far exceeds what we anticipated,” Zillow CEO Rich Barton said in the release. “Continuing to scale Zillow Offers would result in too much earnings and balance-sheet volatility.”

Zillow’s sale of 7000 homes still has a way to go. Pricing on the sale may decline more than expected. A bulk sale may not materialize and prices get chopped on individual sales. Zillow garnered massive negative feedback on TikTok and other sites criticizing its effect on housing and housing prices. They urge no one to buy the homes Zillow needs to sell. This apparently stems from Zillow’s increased volume of purchases mirroring run-ups overall in housing prices and shortages of homes for sale.

The losses from house-flipping piled up, now totaling $1.42 billion, just for the house flipping business, including the write-downs announced today for 2021:

- 2019: $312 million

- 2020: $320 million

- 2021: $789 million (9 months: $539 million + Q4 midpoint estimate: $250 million)

To lose $1.42 billion by flipping houses in the hottest, most inflated, most liquid housing market ever takes a real genius. Its house flipping business showed losses right away in 2019, when it kicked off this scheme.

Back then, some calculated that Zillow lost $109,000 per completed flip. It’s not a good business model because you can’t make money flipping houses by overpaying for them. You have to buy low.

What Next?

The Fed announced its start to tapering after its meeting on November 2-3. It will drop purchases by $15 billion in November, $30 billion in December and scaling down further over time. That means the Fed buying which has kept interest rates low, low, low will start slowing. Buyers may start panic buying again as rates creep up. It still will cost you more to overpay now rather than pay a slightly higher interest rate. Plan now with Winning Mortgage, Winning Home. Pick up a copy today!

In any event, the Winning Mortgage forecast for when to buy a home remains unchanged . Zillow and other buyers overpaid and now regret that. Can you take advantage in your buying after having waited? Keep your powder dry.

CoreLogic Forecast

CoreLogic, a giant mortgage industry information services provider forecast a quick, steep decline in home appreciation over the next 12 months. Take a look how this forecast looks compared to 2007 going into 2008. Where will the bottom end in this cycle?