Inflation Set New Records

March Update- Another new 40 year inflation record. February Update– a new 40 year record on consumer price increases and a new all-time record on producer price increases. Ho hum, yawn, another record in inflation from the Fed and Biden. January Update. Once again, inflation set new records or new 40 year highs. Consumer prices jumped 7.5% on an annual basis in the January report. Once again, this surprised the Fed and others who supposedly are experts. Producer prices show a 9.7% jump. Again, surprising “experts.” We have been predicting continued increases and are not surprised. At least one Federal Reserve official has called for a major increased in interest rates of 1% by July. Part of that is already priced in. This would push mortgage rates possibly as high as 4.5-5.0% by mid 2022 and higher by 2023. We also predicted this. And rates may hit 6-7% for mortgages before pausing. We also expect relatively high inflation to continue for some time.

More Inflation Coming?

December Update. The measures of inflation set new records or new 40-year highs. The Producer Price Index (PPI) numbers released on January 13 reflect wholesale prices. This coincides with the CPI where inflation overall is running at a nearly 40-year high, the Labor Department said Thursday. The producer price index, which measures prices received by producers of goods, services and construction, was up 0.2% for the month. However, the November initial estimate was raised from .8% to 1.0%. On a 12-month basis, the index was up 9.8% to end 2021 (as revised February 15), the highest calendar-year increase ever.

Industry “Experts” Surprised

Despite all indications which informed our projection of where rates are going, industry experts were surprised rates have already broken above 4%. Experts continue to be baffled on inflation, rates and other economic measures which are readily apparent to almost every normal person getting clobbered by price increases.

Some mortgage rate indices topped 4% on Thursday (2/10), blowing past predictions that rates might reach those levels by the end of 2022. Economists had predicted rates would rise as the overall economy stabilized. The latest mortgage rate survey from Freddie Mac puts rates for the 30-year fixed-rate mortgage at 3.69%, while the average rate in the latest mortgage application survey from the Mortgage Bankers Association was 3.83%.

Other indices put mortgage rates even higher. Black Knight‘s Optimal Blue, which provides data for the secondary market, reported the average rate for 30-year conforming mortgages was 4.071% on Friday (2/11) morning. It reported the 30-year rate for FHA-insured mortgages was even higher, at 4.122%.

Joel Kan, associate vice president of economic and industry forecasting, at the Mortgage Bankers Association said rates could head even higher in 2022. “If conditions stay in the current state, we’ll certainly see higher rates,” said Kan.

Inflation Measures

PPI inflation measures flashing 9.7% against the CPI measuring 7.0% for 12 months indicates that the increase in costs may soon flow to consumers at a higher rate than the 7.0%. Producers normally pass on their costs on a lag and the current environment supports their ability to do that. Near the end of 2021, oil refiners were able to boost production of gasoline in great amounts, holding down the price increases seen throughout 2021 for gasoline. Oil itself continued to rise in price, so the lull/pause in price increases for gasoline may be fleeting for filling up your car.

The lesson here may be that killing inflation by acting so late despite prior evidence throughout 2021 may severely impact mortgage rates and house prices. Stay cautious for now. Already there is fear in the market on missing out on low rates, so some overpayment to buy a house continues.

Federal Reserve Ignoring Mandate on Inflation

By law, the Federal Reserve mandates are two and only two. Work towards full employment and manage stable prices/inflation. In 1977, Congress amended the Federal Reserve Act, directing the Board of Governors of the Federal Reserve System and the Federal Open Market Committee to “maintain long run growth of the monetary and credit aggregates commensurate with the economy’s long run potential to increase production, so as to promote effectively the goals of maximum employment, stable prices and moderate long-term interest rates.” The Federal Reserve elected to use the Personal Consumption Expenditure measure as the preferred inflation measure. It is the lowest measure of inflation. As PCE inflation sets new records, consumers continue to suffer high inflation from the Fed’s failures.

Why is it doing everything except those two mandates? In its own words, the federal reserve mandates are:

The monetary policy goals of the Federal Reserve are to foster economic conditions that achieve both stable prices and maximum sustainable employment. At present, the Fed is failing on all its mandates as noted below, especially price stability.

Since rents and Owner Equivalent Rent make up a great portion of the inflation measure, expect inflation and therefore failure of the Fed’s mandate on price stability, to continue well into 2022 or longer. Note the private measures of rent cost increase at 11-17% over the past year! That doesn’t bode well for inflation measures under 6-8%.

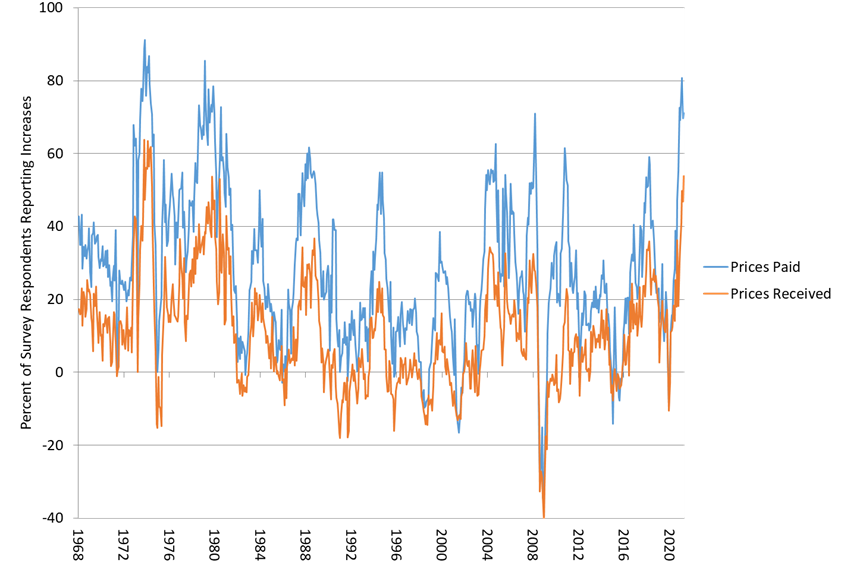

Current Inflation and Future Indicators

The two charts below show performance under the mandates. The Fed has strayed way off course at present. And inflation? On Wednesday December 23, the Fed’s preferred gauge of inflation was released.

Inflation notches a near record 40-year high as measured by the Fed’s favorite gauge-the Personal Consumption Expenditure (PCE) Price Index. Note that PCE measured inflation is well below what consumers see.

- Headline inflation for PCE hit 6.4% in February 2022

5.9% in December 20215.7% in November. This jumps from4.4% in Septemberand5.0% in October! - Core inflation, the Fed’s preferred gauge, hit 5.4% as of February 2022

4.9% through December 2021 4.7% for the 12 months ending November. This rate is more than double the Fed’s maximum target.

Mandate 1 – Price stability

Per the Fed: The Committee judges that inflation at the rate of 2 percent, as measured by the annual change in the Price Index for Personal Consumption Expenditures (PCE), is most consistent over the longer run with the Federal Reserve’s statutory mandate. The Committee has also explicitly noted that the inflation target is symmetric and stated that it “would be concerned if inflation were running persistently above or below this objective.”

If the measure of inflation set new records or new highs for the last 40 years, why has the Fed sat on its butt when this has been obvious for 6-9 months? In fact, it continued its lax money policy throughout 2021 which made price increases worse. Aren’t these highly paid “experts” with massive staffs listening? Read the minutes of a Federal Reserve Board meeting and you’ll see that 50-75 or more staff at the Federal Reserve were clueless in 2021. That includes the key policy makers themselves. But it has been obvious to anyone but them.

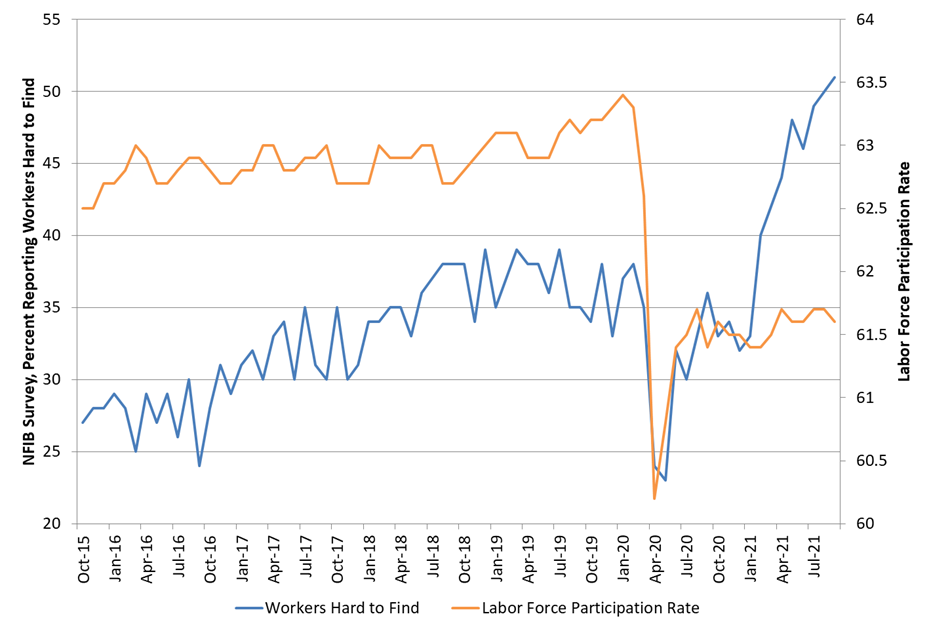

Mandate 2 – Maximum sustainable employment

Per the Fed: Many non-monetary factors affect the structure and dynamics of the labor market, and these may change over time and may not be measurable directly. Accordingly, specifying an explicit goal for employment is not appropriate. Instead, the Committee’s decisions must be informed by a wide range of labor market indicators. Information about FOMC participants’ estimates of the longer-run normal rate of unemployment consistent with the employment mandate can be found in the Summary of Economic Projections (SEP).5 Most recently, the median Committee participant estimated this rate to be 4.1 percent.

How is the Federal Reserve mandate on employment faring?

Status of Achieving Mandates

American households and businesses face a degree of uncertainty unlike anything they have seen since the oil shock of the 1970s. The Federal Reserve set the overnight interest rate at zero, which implies a short-term real rate of negative 5% to 6% after inflation. The intent of negative real rates is to force investment out of savings and into risk assets, including stocks as well as houses. That has happened, with a vengeance, with the fastest home price increases in US history.

Notice the new gap between blue and orange lines. A widening gap between prices paid and prices received often precedes recessions, as in 1973, 1979, 2000, and 2008. This gap does not always predict recessions (it did not in 1993 and 1987, for example). But it strongly suggests that corporate profit margins are under pressure. In some cases, including the US automotive industry, manufacturers have been able to increase profit margins substantially. This result only comes from a scarcity of cars and computer chips allowing dealers to eliminate incentives. Overall, the present inflation is likely to constrain production.

Fed Finally Throws in the Towel to Quit Playing Politics?

Months and months ago we warned that the Federal Reserve’s politics were undermining its mandates, the US, and the citizens. Powell proclaimed inflation “transitory,” a word with no meaning in inflation measures. The weasel wording meant to suggest the Fed was smarter than inflation.

But, in remarks just before December 2021, Chairman Jerome Powell of the Federal Reserve noted that the Fed had misjudged its policies. Will it quit playing politics or just use words to try to blunt the inflation concerns of everyday citizens? That remains to be seen.

When asked about the inflation problems, Powell’s responses suggest that price increases are lasting longer and becoming broader. He didn’t directly say that the pace of reductions in asset purchases would speed up, or that interest rates would rise sooner than than previously expected. But the inference is that inflation is such that the next FOMC meeting (December’s meeting did just this) could see another decrease to the monthly size of asset buys. This would finish the program sooner. Additionally, changes in the FOMC’s forecasts in the summary of economic projections could pull the timing of rate hikes forward.

Powell did say that “The threat of persistently higher inflation has grown.” He later said, “The economy is very strong,” and that asset purchases might be, “wrapping up, perhaps, a few months sooner.”

In speaking of inflation, Powell said it might be time to “retire transitory” as how the Fed describes the forces currently affecting price increases.

What’s the Danger?

EXERCISE CAUTION in all home and market investments for the next two years! Many data points released on November 24 show the Federal Reserve has room to become more aggressive in fighting inflation. The Federal Reserve rate forecast has lagged inflation. While one set of monthly data will not decide everything, indicators point to new flexibility for the Fed. Aggressive action might lead to retracement in the stock market. Retracement for the stock market could mean a fall of 5,000 points on the Nasdaq and 6,000 to 10,000 points on the Dow (20,000+on Bitcoin) over the next 6-12 months. Don’t panic yet, but start moderating your investments and get more cautious in buying a home right now.

In the past, inflation like this preceded a 2 to 3 year drop in housing prices of 25% or more. After that, prices resumed an upward movement. You may pay a slightly higher interest rate or a greatly higher interest rate by waiting a bit. It will depend on the Fed’s reaction. We expect that the Fed will be forced to act differently from its current plan by mid 2022. Now is also the time to abandon any ARM loan. Do not pick an ARM loan, even if that prevents you from buying!!! Look for those with Adjustable Rate Mortgages to perhaps suffer through large increases in the interest rate on that loan type for a number of years.

What has the Federal Reserve Chosen to Focus On Instead of Mandates?

The Federal Reserve created a new Supervision Climate Committee (SCC). It seeks to identify and assess financial risks from climate change and force new standards on banks to comply or else.

Diversity and inclusion has become a priority and the Fed wants it taught in every economics department around the country. And also for the think tanks, governments, businesses, and many other organizations that train and employ economists.

The Federal Reserve has purchased $8.5 trillion of assets to subsidize over-spending by the federal government.

Since the start of the COVID-19 pandemic, the federal government has injected $5.8 trillion of spending power into the US economy. That’s about two-fifths of the consumption component of GDP. It created a burst of consumer spending. It also created the highest inflation in forty years. Side effects of chronic shortages of key commodities, supply chain disruptions, and a bulge in the trade deficit followed.

Despite the gigantic stimulus, the economy is slowing. And under these extraordinary circumstances, the usual tools of forecasting are ineffective. Rarely have economic forecasts diverged as widely as they do now.

Don’t get caught unprepared. Pick up a copy of Winning Mortgage, Winning Home.