Headwinds in the Housing Market

Headwinds in the housing market for new homes has dampened sales volumes. The market rally to ever higher sales and prices slowed dramatically in the second quarter of 2021, as we predicted. Sales of newly built homes fell for third consecutive month. New home sales continued to slip in June, falling 6.6% from May to a pace of only 676,000, according to a recent study from the U.S. Census. It’s the third straight month of decreases.

June’s pace represented an almost 20% drop from June 2020’s pace. The median sales price of new houses sold in June 2021 was $361,800 with an average sales price of $428,700, about 6% higher than a year ago.

Once again, migration to the South led the way with a seasonally adjusted pace of 367,000. Heavily regulated, land restricted, business unfriendly, and high taxed states in the Northeast and West slowed the pace in those areas. Sales in the West (186,000) and the Northeast (31,000) trailed well behind the South. That pace for the Northeast represents a drop of 40.4% from June 2020. The Midwest, at 92,000 reflects limited migration and out-migration and limited areas for new construction. Pick up a copy of Winning Mortgage, Winning Home to prepare for the headwinds!

Mortgages for Newly Built Homes

The Mortgage Bankers Association data for June 2021 shows mortgage applications for new homes decreased 23.8% from a year ago.

By product type, conventional loans were 74.4% of loan applications, FHA loans comprised 14% percent, RHS/USDA loans were 1% and VA loans were 10.6%.

The average loan size of new homes increased from $384,323 in May to $392,370 in June. Based on an average sales price of $428,700, down payments averaged a bit under 10%. As usual, conventional loans dominated the market with a 75% share of loans made. FHA loans and VA loans (HUD guaranteed) have difficulty being competitive and likely represented the highest LTV loans in the group. By implication, conventional loans likely had down payments averaging above 10%. FHA and VA loans likely were well below 10% down payments. High price remains one of the headwinds in the housing market. Limited supply of new homes also represents one of the headwinds in the housing market.

Mortgages for Second Homes and for Investors

We wrote about the changes being made to the involvement of Fannie Mae and Freddie Mac in second homes and rentals. Nearly half a year ago we explained what that meant. Recent information and statistics bear out our forecast. To recap, January brought the announcement that FHFA and the Treasury would limit investment-property loans and second-home mortgages. This limit would apply as a ratio against the total loans bought by Fannie Mae and Freddie Mac. Loans of this type could not exceed 7% of Fannie and Freddie’s balance sheet. At the time, Fannie and Freddie held more than 7% of these loans on the balance sheet and purchases comprised about 14% of new loans.

Some lenders were caught blind. Recent earnings calls for two large lenders, Homepoint and UWM showed substantial charges and negative impacts. They had to sell loans they originated to buyers at a higher interest rate than planned. Fannie and Freddie purchases provided the lowest interest rates but were capped out from purchases. Homepoint and UWM got sticker shock due to the pipeline “pricing adjustments.”

Inside Mortgage Finance just reported (mid-August) that Fannie and Freddie impacts from the change. It resulted in a drop in volume of these loans of more than 33% from the first quarter.

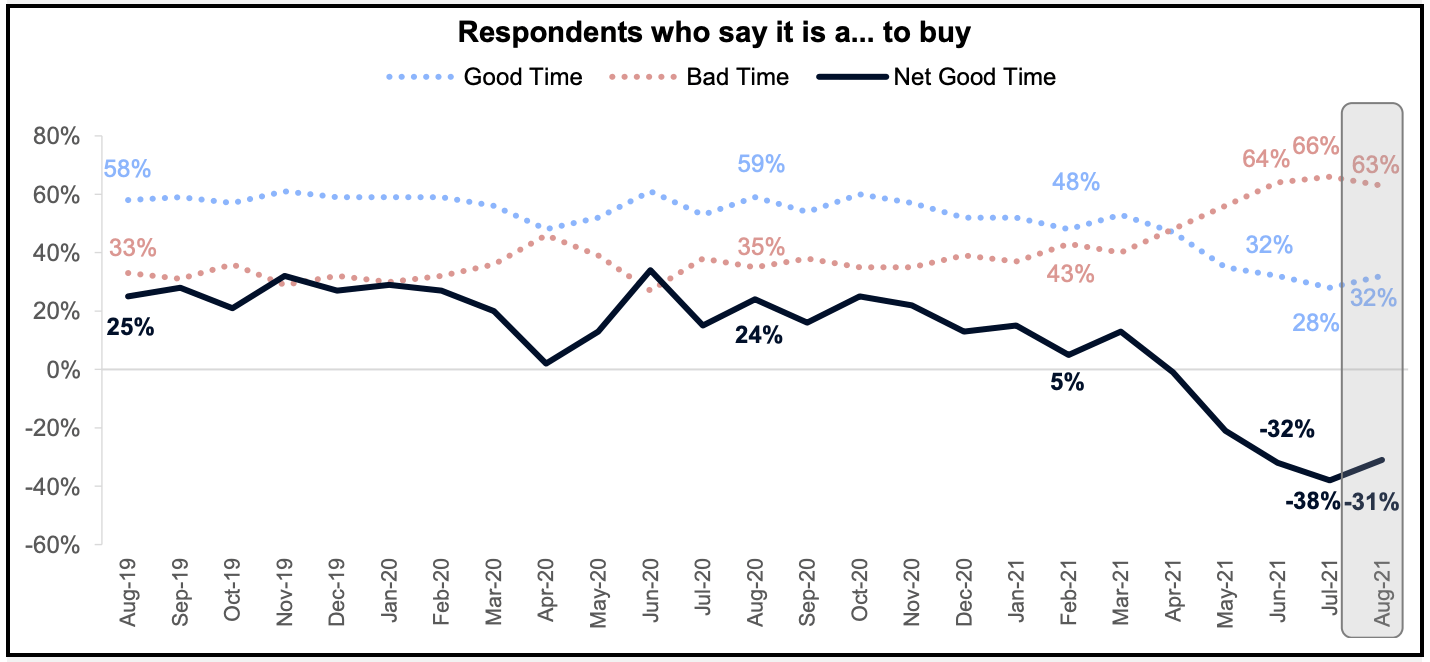

Good or Bad Time to Buy a Home?

According to a recent study by Fannie Mae, almost two thirds of Americans have a low opinion about buying a home in the current market. In fact, the market for buying a home showed more negative sentiment than positive sentiment starting in the 2nd quarter of 2021. Opinion has only gotten worse since then.