Consumer Sentiment and Recession

On August 13, the university of Michigan released its latest survey on consumer sentiment. Contrary to expectation of a steady reading, the measure of consumer sentiment plunged to its lowest level in a decade. In fact, the drop was extreme on a monthly basis. Only two times in the last 50 years has the drop of any similar magnitude from one month to the next occurred. One drop coincided with the start of popping the housing bubble in 2007-2009 and the other the initial Covid pandemic in April 2020. The chart below outlines a history of more than 50 years of measurement. Note the correspondence of drops in consumer sentiment and recession. 1973-1975, 1979-1981, 1990-1991, 2007-2009 and the start of pandemic in 2020.

The drop cut across all sub-groupings, income, age, and education, and spanned all regions. The survey’s gauge looking forward of consumer expectations slid to 65.2 from 79.0 in July. This potentially foreshadows a second big drop next month. The survey also showed consumers raising their expectations for medium term inflation. Consumer sentiment and recession don’t always mirror each other, but they have coincided very frequently over the past 50 years. Large negative changes have been a good predictor of recession multiple times. Read more about our concerns about the current excessive inflation, its causes, and potential effects on housing and mortgages.

Wrong Time to Buy a Home?

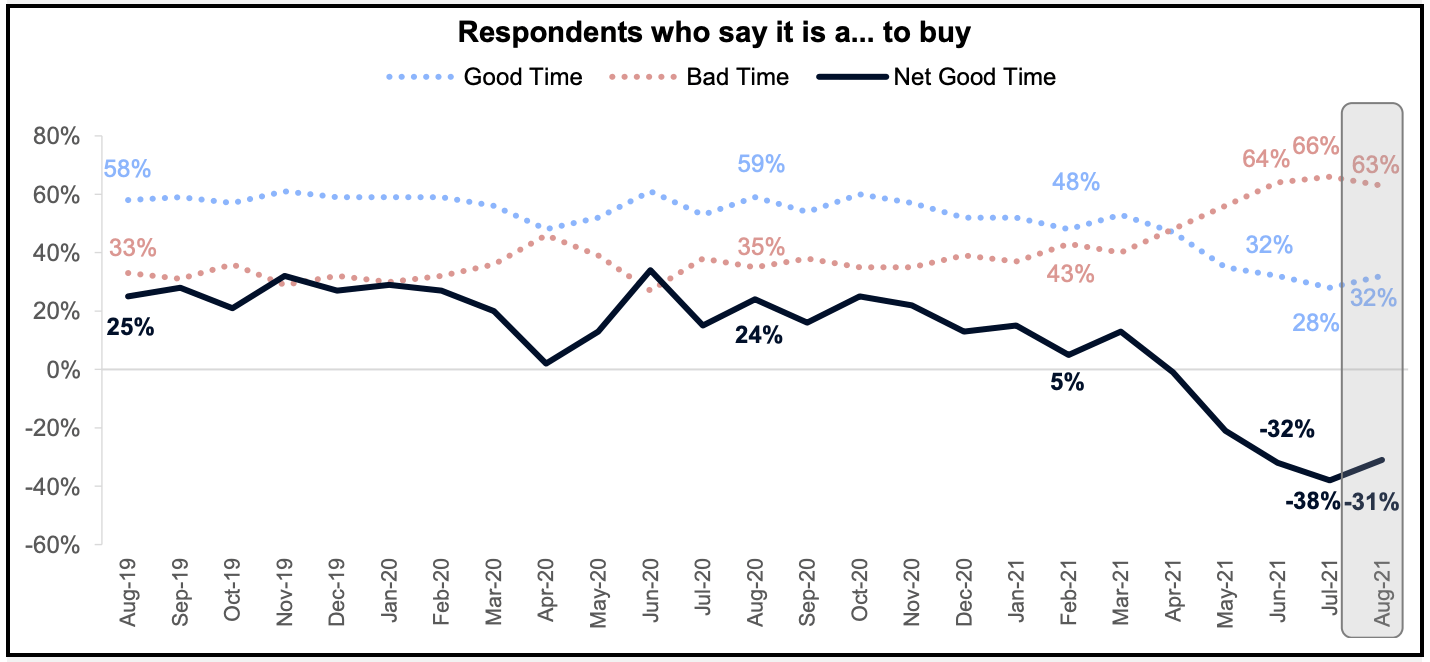

According to a recent study by Fannie Mae, almost two thirds of Americans have a low opinion about buying a home in the current market. In fact, the market for buying a home showed more negative sentiment than positive sentiment starting in the 2nd quarter of 2021. Opinion has only gotten worse since then.